Investors

We focus on preserving capital and delivering attractive risk-adjusted returns

Our Focus is on:

Transactional Commodity Trade Finance

Transactional Commodity Trade Finance is the financing of trade flows, on a self-liquidating basis (meaning that repayment results from the sales-proceeds of the goods being financed, collected directly by the Lender) and whereby monitoring takes place per individual transaction, during each stage of the flow.

The flows can cover multiple geographies and have numerous origins and destinations.

In general, the following financing stages are identified:

- Production / performance / prepayment stage X

- Logistics stage (including in-land and vessel transit, freight and ancillary charges) V

- Receivables stage (including export L/C-backed, credit-insured or open account receivables) V

- Margin financing (commodity price hedging agreement) X

- Foreign exchange or interest rate hedging financing X

Within transactional commodity finance Syn-Cap will provide finance for only logistics and receivables stages. Syn-Cap will not engage in margin or hedging financing or prepayment stage. The main security/collateral is provided by a security interest over the financed goods and accounts receivables. Sub accounts will be opened for each obligor, which are solely controlled by SynCap’s management, to ensure self-liquidation of the transactions. Suppliers will be paid directly from these accounts and receivables of the transaction will be received on the same account. However, due to the dynamic nature of the financed transactions (moving goods), primary focus remains on maintaining robust procedures and mechanisms to maintain operational control over the goods financed and the collection of the sales proceeds.

The operational controls and structuring around the physical transaction lie at the heart of transactional finance. Via a successive reporting of movement through the propriety IT system, Syn-Cap is able to follow each transaction and know at any time exactly where the goods are located. This, combined with a level of documentary control/transfer of title, provides the main credit comfort. Thus, the supplier, route, destination, buyer and sales instrument should correspond to the desired (Investment Committee approved) risk level.

- Supply Chain Finance

- In-Transit Finance

- Import / Export Finance

- Inventory Finance

- Receivables Finance

Investment Focus

Funds Program

SynCap’s 3Yr Term closed-ended transactional commodity trade finance fund comprises a portfolio of high-quality in-transit and receivables financing assets originated by specialised physical commodity trading firms with payment risk backed by investment grade credit support. The Fund allows investors to collect a semi-annual floating rate coupon as well as participate in the profits generated by SynCap over and above the income paid out to investors, thus giving fund investors income as well as upside participation. The Fund as well as the fixed-income and floating rates securities SynCap manages and/or advises are not often available elsewhere in the credit markets. Synthesis provides access to transactional commodity trade financing of pre-sold goods where transactions of 20-90 days tenor are backed by investment grade credit support providers. This produces SOFR + 4%-6% returns with very low volatility, de-correlated from capital markets.

We provide funding for companies who have strong business models, but need outside help to finance their larger transactions.

- We finance transactions, not companies. We are not a lender in a traditional manner and we do not provide loans to companies. All funding that we provide is repaid upon completion of the transaction and our exposure ends at that point.

- We step directly into the transaction. Most of the transactions that we finance are the simple sales of goods to end buyers. In this case, we are bridging the time gap between dispatch of the goods by the supplier, and receipt by the buyer. We pay the seller directly, we take ownership of the goods until receipt, and collect sales proceeds directly from the buyer.

- All transactions financed are required to have a letter of credit or credit insurance provided by an investment grade institution. This provides an additional layer of protection for every deal.

We see the common advantages of investing in a trade finance strategy as:

- Producing similar returns to direct lending whilst removing the actual risk of the SME.

- Being secured on an actual sales price, rather than a mere valuation like in property lending.

- Short-dated, self-liquidating transactions means that the investor will have no long-dated exposures to geo-political or credit risks.

Securities Program

- Low default rates and high recovery rates

- Exceptional risk-adjusted returns regardless of market conditions

- Excellent floating rate returns protecting investors in a rising interest rate environment

- Short tenor transactions with default rates significantly below other asset classes*

- Payment risk in each transaction is credit enhanced by insurance or letters of credit protected by banks, each with a minimum credit rating of BBB+, further reducing risk of financial loss

- A highly experienced team of trade and commodity finance experts with deep knowledge of the traditional, robust structuring and monitoring techniques which are no longer available at many banks, minimising transaction risks

Enabling institutional investors to access the $4 trillion per year physical commodities trading market

SynCap’s investors benefit from exposure to a new sub-asset class within Private Debt.

INVESTMENT OPPORTUNITY

- Diversified portfolio across commodities, counterparties, geographies and financing structures

- Low volatility of returns due to returns being generated from floating rate funding facilities granted to borrowers and high average facility utilisation rates

- Low correlation vs the broader financial market

- Capital deployed in accordance with SynCap’s ESG Policy

RISK-ADJUSTED PRICING

- Transactions with payment risk backed by investment grade credit support

- Historic low default rates compared to other asset classes

DEAL MANAGEMENT

- Rigorous due diligence and transaction structuring

- On-going monitoring and risk management

Investment Strategies

SynCap pursues low-risk “Specialty Finance” investment strategies that fall under the Private Debt sub-asset class within the universe of “Alternative Investments”.

SynCap’s management team brings decades of experience in structuring commodity finance transactions where the principal investment/funding strategy is based on placing the lender astride the asset conversion cycle, at the point of conversion to cash, ahead of all other creditors. SynCap seeks to apply maximum risk mitigation at all times. This means that risks are mitigated in regard to (amongst other factors) counterparty, operational, country, reputational, fraud, environmental, compliance and credit risks. Certain criteria are in place to select eligible obligors, collateral and jurisdiction. The main collateral in commodity trade finance is provided by a security interest over the financed goods and accounts receivables. However, due to the dynamic nature of CTF transactions (moving goods, etc.), the primary focus remains on maintaining robust procedures and mechanisms to preserve operational control over the goods financed and the collection of the sales proceeds. These operational controls and structuring around the physical transaction lie at the heart of transactional commodity trade finance. SynCap’s unique combination of expertise in origination, risk, compliance and transaction management ensures in-house experience in successfully structuring and investing in such transactions.

SynCap, at present, focuses on the following sub-segments within commodity trade finance:

Transit Finance

Transit finance is a loan arrangement either with the buyer or seller of goods in a situation where all aspects of a trade transaction are agreed apart from the payment date. Typically, this could be because the seller wants to get paid upon shipment, but the buyer will only pay upon receipt of goods. Lender steps into the transaction by providing liquidity and pay for the goods upon presentation of shipment documents. The loan is repaid upon shipment to final destination, from the sales proceeds of the transaction.

Risk Mitigation: Letter of Credit, insured goods, assignment of sales proceeds, documentary review.

Inventory Finance

Inventory finance comes in many forms but simply it is used when the goods are not in transit but waiting in a warehouse in either exporting or importing country for onwards export/distribution. When goods are in inventory, the shipping documents have already been released so instead warehouse warrants/receipts are issued evidencing that the goods are held to the order of the Lender. Goods can be pre-sold or unsold. If unsold, there’s risk that the borrower is unable to sell some or all the goods in time, thus risking main source of repayment. In this case, the goods should be hedged with the proceeds of the hedge assigned to the Lender. If presold, the performance risk is on the off taker of the borrower. Goods may not need to be hedged if the purchase and sales prices are back-to-back or fixed.

Risk Mitigation: Letter of Credit, insured goods, credit insurance, assignment of proceeds, collateral management, hedging, cash margin, documentary review

Receivables Finance

Receivables finance is required when goods are sold to a buyer with deferred payment terms. In this case, the security for the lender is proceeds of the sales invoice. Receivables financing is often done by “factoring” where the lender purchases the invoice and becomes the legal owner of the debt or “invoice discounting” where the borrower remains the legal owner therefore responsible for collection and enforcement of the debt.

Risk Mitigation: Letter of Credit, credit insurance, financial analysis, assignment of proceeds, documentary review.

Commodity Trade Finance as an Asset Class

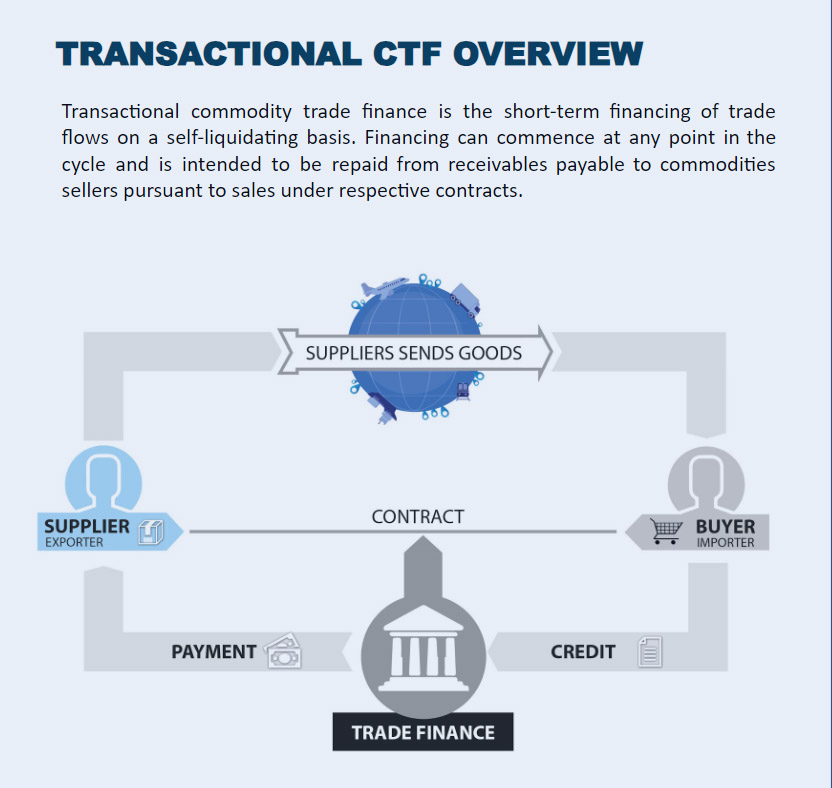

TRANSACTIONAL COMMODITY TRADE FINANCE

Transactional Commodity Trade Finance is the short-term financing of trade flows on a self-liquidating basis. Financing can commence at any point in the cycle and are intended to be repaid from receivables payable to commodities sellers pursuant to sales under respective contracts.

Commodity trade finance (“CTF”) has traditionally been the preserve of commercial banks and a core part of their offering to corporate clients and especially multinational trading houses and commodity producers, processors and distributors. Typically, commercial banks actively support these categories of clients as frequently the credit risk exposure is versus the buyer of the goods traded which in many instances are investment grade corporates or where the credit risk exposure is reduced through credit insurance or documentary credit instruments from the purchasing party’s bank. Over recent years many new non-bank financial companies and investment vehicles have stepped in to fill the gap left by numerous large financial institutions that have pulled out of the market or scaled-back their global CTF loan books due to significant pressures caused by increased regulatory capital requirements for CTF lending activities.

The diagrams below provide a high-level overview of CTF transaction features and characteristics

WHY TRADE AND COMMODITY FINANCE NOW?

THE MOMENTUM

TRADE FINANCE IS A SIGNIFICANTLY UNDEREXPLOITED MARKET

- Global trade has nearly doubled since 2000 to around US$28.5 trillion in 2021

- Trade finance revenues are currently estimated at c. US$51 billion in 2021, and are expected to grow

- There is a lack of data on the trade finance funding gap, but the estimate amounts to US$1.7 trillion (WTO 2021 estimates).

Advantages for Investors

OPPORTUNITY

The trade finance funding gap has increased to US$1.7 trillion (WTO 2020 estimates). Regulatory changes are driving banks away from commodity trade finance. Large infrastructure programmes are increasing demand for commodities. A genuine need for transparent and accountable alternative credit providers who adhere to their published lending criteria has emerged.

METHOD

Focus on strategic global supply chains and relying on a premium proprietary origination network. Loans with a short revolving tenor which are over-collateralised by liquid commodities. Receivables which are either investment grade or enhanced by bank instruments/credit insurance from institutions with a minimum credit rating of BBB+. Robust credit model and risk analysis, strict concentration limits, on-site due diligence and industry leading monitoring agents.

USP

Tailored working capital and commodity finance solutions World-class team members. Short term, over collateralized, self-liquidating investment strategy Cutting edge proprietary technology which digitises the operating model, minimising fraud and operational risk.Investment Process

ORIGINATION & STRUCTURING

- Proprietary deal flow thanks to SynCap Origination team’s experience and deep understanding of established market practices through decades of financing commodity traders, producers and processors throughout their careers.

- Stringent due diligence on borrower, guarantors, commodity and the market by mobilizing our network and third-party service providers

- Continuous KYC, Compliance & ESG screening

- Regular on-site visits with customers, ports and warehouses

- Closely following the markets and commodity prices via certain subscriptions

RISK MANAGEMENT & EXECUTION

- Risk assessment function independent from origination to ensure proper structuring and that risks remain within risk appetite of the Investment Committee

- Liaise with legal counsel regarding structuring and documentation, ensure documentation is duly executed

- Investment Committee => Unanimous decision

- Smooth execution enabled through a state-of-the-art proprietary transaction management platform

- Liaise with 3rd party service providers with whom management has decades of experience working together

- Periodic financial review of borrowers

TRANSACTION MONITORING & REPORTING

- Transaction flow monitoring through proprietary transaction management technology platform

- Continuous verification of commodity movement and documentation

- Control and reporting of concentration limits

Risk Management

PORTFOLIO PARAMETERS

- Strict concentration limits by counterparty, commodity, country and maturity, actively managed to ensure optimum diversification

- Transaction tenors typically 30-90 days, maximum 180 days

- Robust procedures and IT systems for active monitoring and control of all transactions

- Self-liquidating transaction structures with security/title/control over one or more of commodities, contract rights, payment flows, collection accounts and other transaction assets

- Investment grade off-takers (buyers of the commodity) or credit-enhanced through letters of credit, bank guarantees or trade credit insurance issued by financial institutions with a rating of BBB+ or above

- Diversified across agricultural, metals and energy sectors

KEY RISKS IN TRADE FINANCE

- Performance risk on seller

- Payment risk on buyer

- Operational risk

- Price risk

- Fraud risk

MAIN MITIGANTS

- Only produced goods are financed, therefore no performance risk exposure (vs producers)

- Security over underlying goods, contracts, accounts

- Over collateralisation by cash margins

- Independent collateral management and monitoring together with service providers the management has collaborated with for decades

- Marine/credit or any other insurance assigned to lender where the policies are strictly scrutinized

- Credit enhancement of payment risk if sub-investment grade

- Robust infrastructure for monitoring and control (including state of the art digital platform)

- Close relations with all counterparts and verification throughout the transaction life-cycle.

Investor Portal Login

Login to portal area for investor information.

Contact us for login information.

Username or Password is incorrect